FX-Strategy 21 Aug 2024

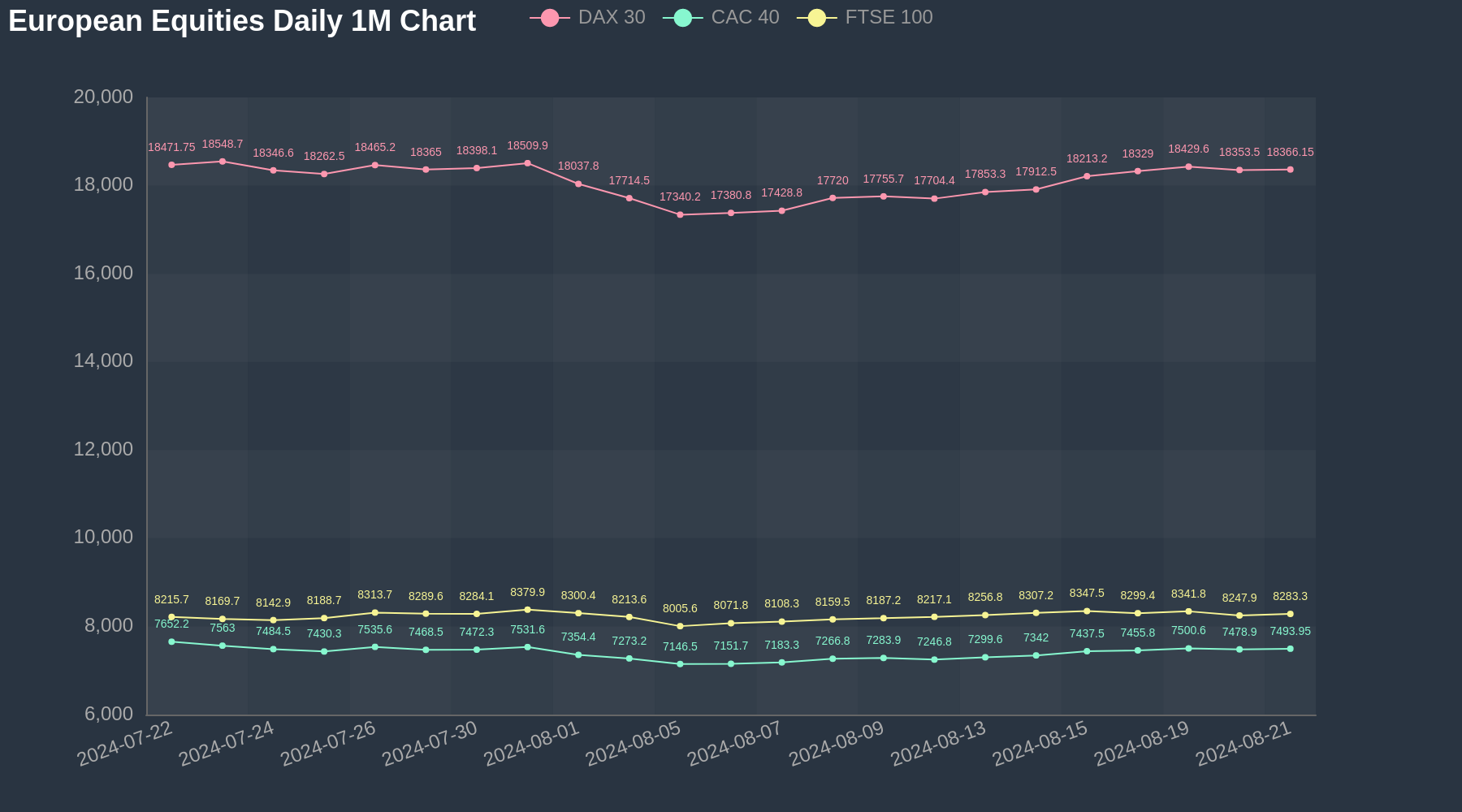

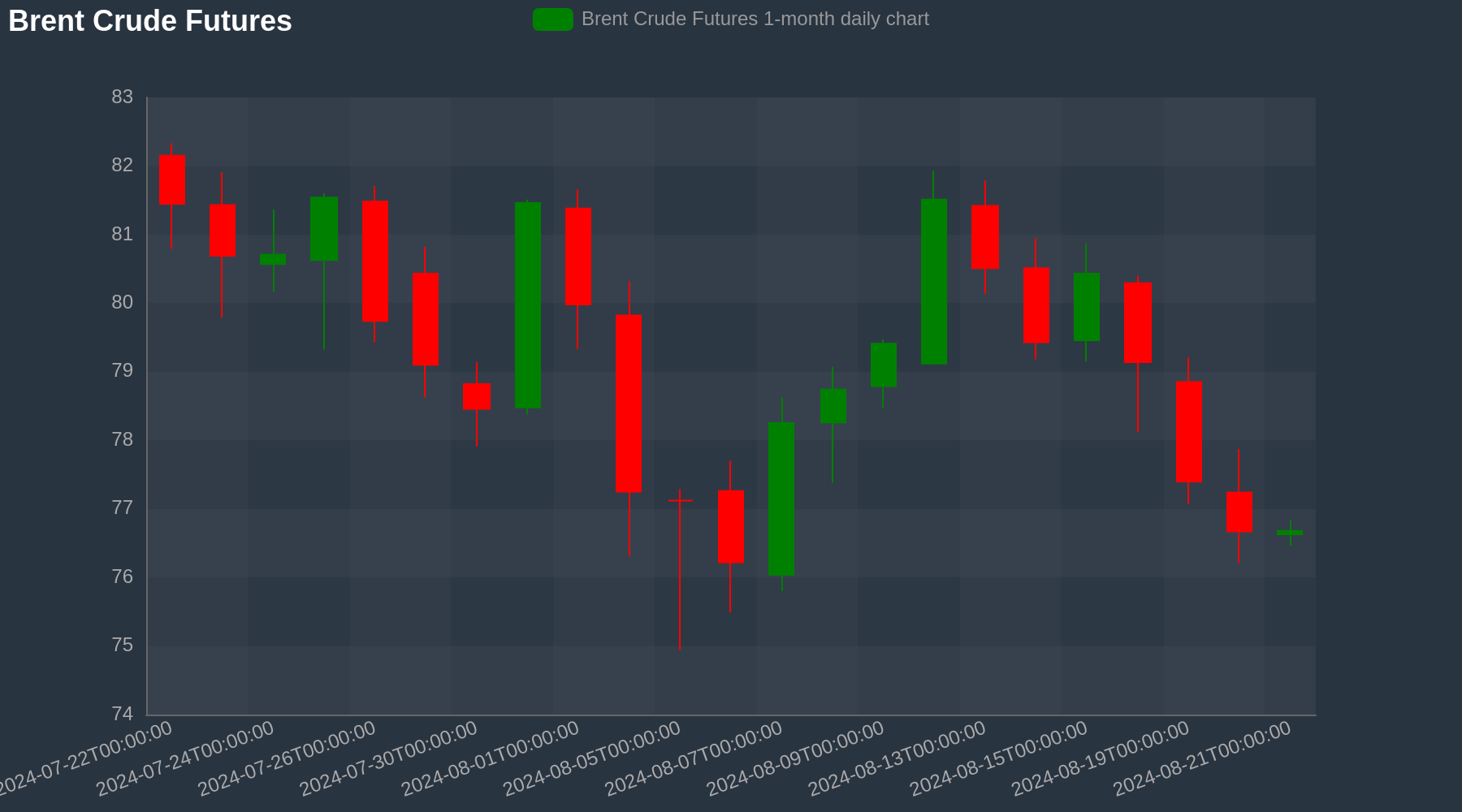

In the G10 FX Market, CAD and USD are the top gainers today while JPY and NOK are the top losers, down -0.43% and -0.17% versus the dollar, respectively. In the Asian equities, markets were trading stronger today. The Nikkei 225 was trading at 37958.5, up 0.99%. The Hang Seng was trading at 17342.5, up 0.03%. In the European equities, indices were trading stronger today. The FTSE 100 was trading at 8283.3008, up 0.43%. The CAC 40 was trading at 7493.9502, up 0.2%. The DAX 30 was trading at 18366.1504, up 0.07%. Looking at Equity Futures so far,The SP500 Futures was trading at 5606.5, up 0.08%. In the Energy space, Oil futures were trading firm today. The WTI Crude Futures was trading at 73.015, up 0.06%. The Brent Crude Futures was trading at 76.675, up 0.01%.

Download intraday historical Forex data in CSV files for free at TraderMade

European Equities Daily Chart (1-month)

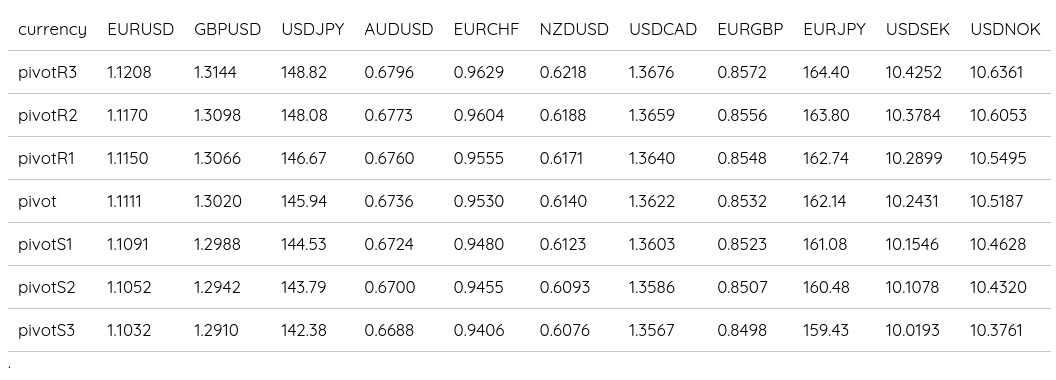

Daily FX Pivots

Brent Crude Daily Chart (1-month)

Forex Chart and Technical Analysis

EURUSD Chart (Two-week)

Strategy: Support at 1.1091 for 1.115

Short-term view: EURUSD support comes in at 1.1091 MACD and RSI have a bullish bias. Hence, we see a bounce to 1.115 enter at 1.111. Below 1.1091 to open 1.1052

GBPUSD Chart (Two-week)

Strategy: Support at 1.2988 for 1.3066

Short-term view: GBPUSD MACD and RSI are flat but support comes in at 1.2988 and we see a rise to 1.3066 enter at 1.3014. Below 1.2988 to open 1.2942

USDJPY Chart (Two-week)

Strategy: Resistance at 146.67 for 144.53

Short-term view: USDJPY resistance comes in at 146.67 MACD and RSI have a bearish bias. Hence, we see a dip to 144.53 enter at 145.96. Above 146.67 to open 148.08

AUDUSD Chart (Two-week)

Strategy: Support at 0.6736 for 0.676

Short-term view: AUDUSD MACD and RSI are flat but support comes in at 0.6736 and we see a rise to 0.676 enter at 0.6744. Below 0.6736 to open 0.6724