FX-Strategy 15 Feb 2024

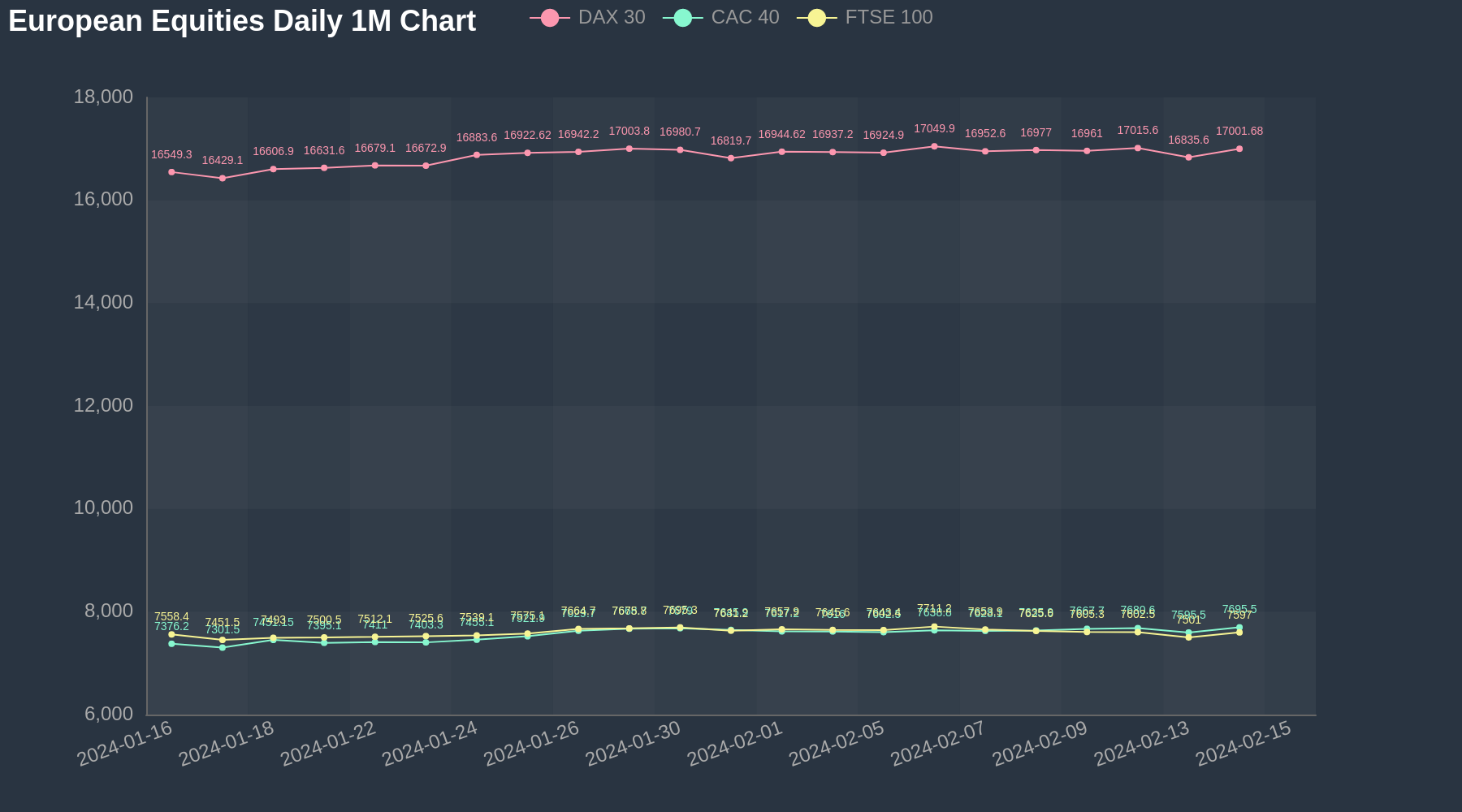

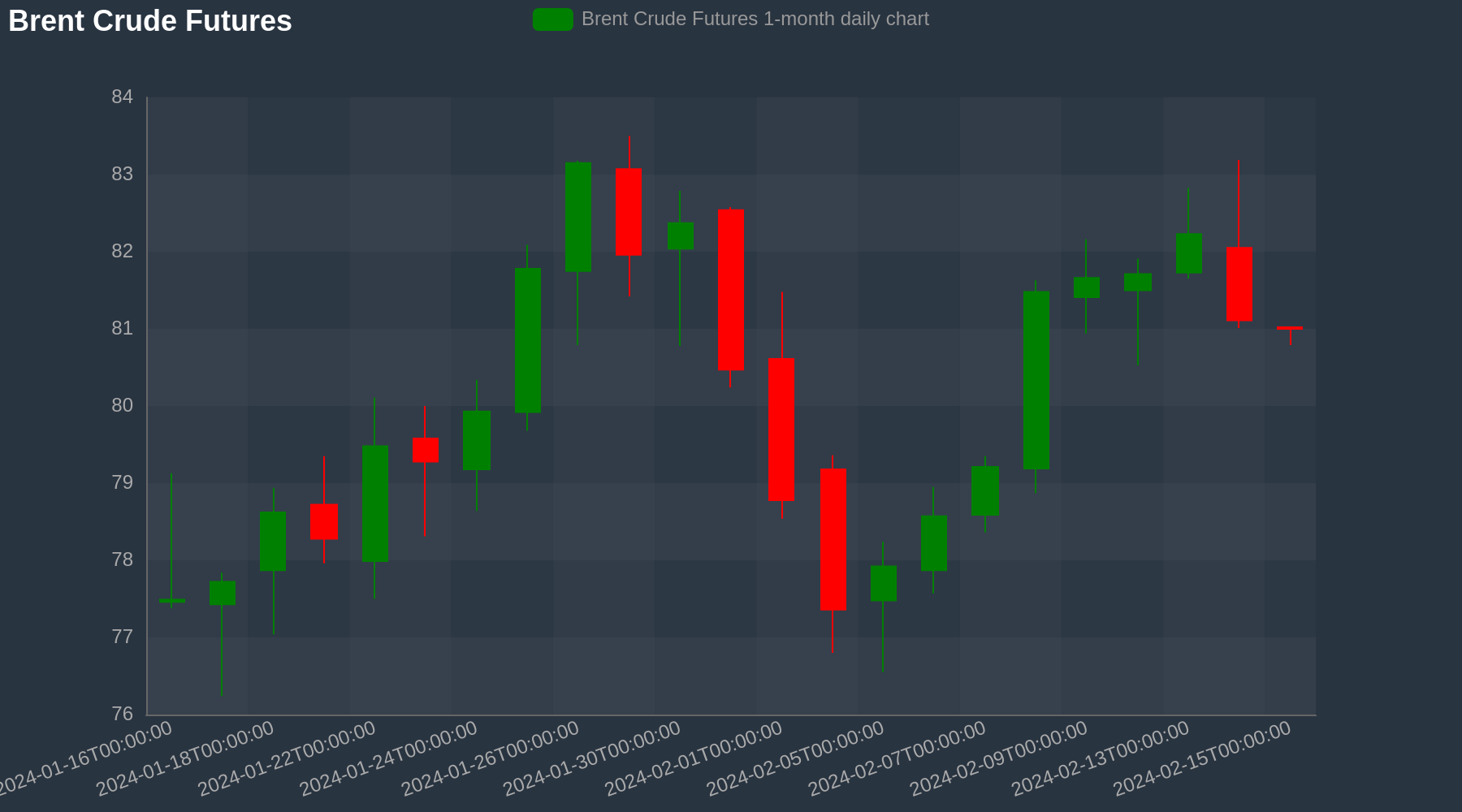

In the G10 FX Market, JPY and CHF are the top gainers today, up 0.31% and 0.14% versus the dollar while USD and NOK are the top losers. In the Asian equities, markets were trading stronger today. The Hang Seng was trading at 15961.0, up 0.33%. The Nikkei 225 was trading at 38175.5, up 0.13%. In the European equities, indices were trading mixed today. The DAX 30 was trading at nan, flat nan%. The CAC 40 was trading at nan, flat nan%. The FTSE 100 was trading at nan, flat nan%. Looking at Equity Futures so far,The SP500 Futures was trading at 5006.25, up 0.07%. In the Energy space, Oil futures were trading weaker today. The Brent Crude Futures was trading at 80.998, down -0.13%. The WTI Crude Futures was trading at 76.157, down -0.15%.

Download intraday historical Forex data in CSV files for free at TraderMade

European Equities Daily Chart (1-month)

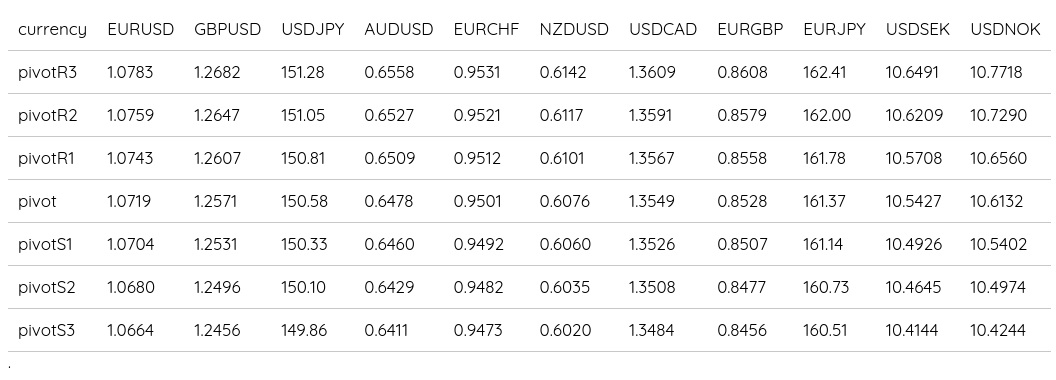

Daily FX Pivots

Brent Crude Daily Chart (1-month)

Forex Chart and Technical Analysis

EURUSD Chart (Two-week)

Strategy: Support at 1.0704 for 1.0759

Short-term view: EURUSD support comes in at 1.0704 MACD and RSI have a bullish bias. Hence, we see a bounce to 1.0759 enter at 1.0722. Below 1.0704 to open 1.068

GBPUSD Chart (Two-week)

Strategy: Resistance at 1.2607 for 1.2531

Short-term view: GBPUSD MACD and RSI are flat but resistance comes in at 1.2607 and we see a dip to 1.2531 enter at 1.2582. Above 1.2607 to open 1.2647

USDJPY Chart (Two-week)

Strategy: Resistance at 150.58 for 149.86

Short-term view: USDJPY resistance comes in at 150.58 MACD and RSI have a bearish bias. Hence, we see a dip to 149.86 enter at 150.34. Above 150.58 to open 150.81

AUDUSD Chart (Two-week)

Strategy: Support at 0.6478 for 0.6509

Short-term view: AUDUSD support comes in at 0.6478 MACD and RSI have a bullish bias. Hence, we see a bounce to 0.6509 enter at 0.6488. Below 0.6478 to open 0.646