Advanced Forex Playbook: 17 Pro Strategies for Serious Traders in 2024

Did you know that in the ever-evolving Forex market, over 85% of traders fail to achieve consistent profitability? It's a startling statistic, but it hides an illuminating truth: success in Forex isn't about luck; it's about strategy.

You might be wondering, "Is there a secret playbook that the successful 15% are using?" The answer is not straight forward, but it revolves around advanced strategies that are not just about reading charts, but understanding the market's deeper rhythms.

If you're feeling that tinge of frustration, watching market waves crash against your trades with little to no return, you're not alone. Many traders, whether novices in their twenties or seasoned pros in their forties, find themselves at this crossroad.

The key lies not in working harder, but smarter, with strategies tailored for today's market realities.

So, let's turn the tables. In this article, we delve into the "Advanced Forex Playbook: 10 Pro Strategies foe Serious Traders in 2024," a compilation of sophisticated, tried-and-tested tactics that are set to redefine your trading journey. From subtle shifts in approach to groundbreaking techniques, these strategies promise to unlock new dimensions in your Forex trading experience.

Ready to be part of that successful 4%? Let's begin.

Understanding the Essence of a Powerful Strategy

The key to a powerful Forex strategy lies in its ability to adapt to market changes while maintaining a strong foundation in market analysis and risk management.

In 2024, the most effective strategies are those that embrace technological advancements, incorporate a thorough understanding of global economic shifts, and utilize innovative trading techniques.

Let's explore these strategies, each uniquely tailored to navigate the 2024 Forex market effectively.

- Algorithmic Harmonic Pattern Trading:

This strategy leverages advanced algorithms to identify and capitalize on harmonic patterns in the Forex market. It's about precision and timing, utilizing technology to spot these complex patterns that traditional analysis might miss. - AI-Driven Sentiment Analysis:

Here, artificial intelligence is used to guage market sentiment through the analysis of news, social media, and economic indicators. This strategy taps into the collective mood of the market, offering insights into potential market movements. - High-Frequency Trading (HFT) Techniques:

Adapting HFT strategies, known for their speed and efficiency, can provide an edge in 2024's fast-paced market. This involves making a large number of trades in fractions of a second, capitalizing on minute price movements. - Global Macro-Strategic Trading:

Given the ongoing global economic shifts, this strategy focuses on trading based on global economic scenarios and events. It requires a deep understanding of economic fundamentals and their impact on currency values. Stay up to date with our Economic calendar. - Risk Reversal Options Strategies:

This strategy involves combining call and put options to create a unique position that minimizes risk. It's particularly useful in volatile markets, offering a way to hedge while keeping the door open for profit. - Basket Trading:

This involves trading a basket of currencies rather than a single pair. By diversifying, traders can spread risk and capitalize on the relative strength of currencies against multiple counterparts. - Quantative Analysis-Based Trading:

Utilizing quantitative analysis, this strategy leverages mathematical and statistical models to identify trading opportunities, a method that's especially potent in a data-driven trading environment. - Intermarket Analysis Strategies:

These strategies involve analyzing related markets such as bonds, stocks, and commodities to predict Forex market movements. Understanding these correlations can provide a significant advantage. - Psychological Level Trading Strategy:

This focuses on currency pairs that end in 000 or 500, known as 'psychological levels.' Traders exploit the common human tendency to place orders at these rounded numbers. - Carry Trade Optimization:

In this strategy, traders profit from the interest rate differential between two currencies. The key in 2024 is to optimize these trades by carefully selecting currency pairs with favorable economic conditions. - Machine Learning and AI in Forex Trading:

The use of AI and machine learning algorithms to predict market trends is no longer a thing of the future. In 2024, these technologies are helping traders analyze vast amounts of data for more accurate trading. - Risk Diversification Strategies:

In response to market unpredictability, diversifying risk through varied currency pairs, trading in different time zones, and using a mix of short-term and long-term strategies is a prident approach. - Scalping in Volatile Markets:

Scalping, a strategy that involves making numerous trades to profit from small price changes, has become more refined in 2024. With increased market volatility, scalping provides opportunities for quick gains. - Utilizing Economic Calendar for Fundamental Analysis:

Staying updated with economic events and news releases is more critical than ever. Advanced traders are using economic calendars to plan trades around major economic announcements for maximum impact. - Carry Trade Strategy:

This strategy involves borrowing from a currency with a low-interest rate and investing in a currency with a higher interest rate. With the shifting rates globally, carry trade is seeing renewed interest. - Hedging Against Political Risks:

Given the political upheavals and their impact on currency markets, hedging strategies have become essential for managing political risks effectively. - Integrating Technical and Fundamental Analysis:

While this is not yet new, the integration of technical and fundamental analysis has become more sophisticated in 2024. Traders are finding that a balanced approach leads to more consistent results.

Demystifying the 100% Winning Myth in Forex Trading

The allure of a '100% winning strategy' in Forex trading is something that captivates many traders, especially those new to the field. It's a concept that seems to promise endless profits with little to no risk. However, the reality of Forex trading is far more nuanced and complex.

The idea of never losing in Forex trading is, to be frank, a myth. The Forex market, like any financial market, is inherently unpredictable. Prices can be influenced by a myriad of factors ranging from geopolitical events to changes in economic indicators. Therefore, the notion of a strategy that guarantees success in every trade is fundamentally flawed.

Take, for instance, the strategy of relying solely on technical indicators. While these can provide valuable insights, they're not infallible. A trader who believes their strategy is unbeatable might overlook key market signals, leading to significant losses.

A more realistic approach to Forex trading involves accepting the inherent risks and understanding that losses are a part of the trading process. Successful Forex trading is about the long game – it's about achieving a positive balance over time, not winning every single trade.

Managing risk effectively, diversifying trading strategies, and continually learning and adapting are key components of a realistic Forex trading approach. For instance, implementing stop-loss orders can help manage risk by setting a predetermined point at which a losing trade will be closed.

Top Techniques in Forex Trading 2024

As the Forex market evolves, so do the strategies and techniques used by traders. In 2024, several techniques are standing out for their adaptability to current market conditions.

- Algorithmic Trading: With the advancement of technology, algorithmic trading has become increasingly popular. These algorithms can process vast amounts of data at incredible speeds, making trading decisions based on predefined criteria.

- Social Trading and Copy Trading: Platforms that allow traders to observe and copy the trades of experienced professionals have become quite popular. This technique is especially beneficial for beginners who can learn from seasoned traders.

- Scalping: This strategy involves making a large number of trades within a short time frame, capitalizing on small price movements. Scalping requires quick decision-making and a deep understanding of market dynamics.

- Swing Trading: For those who prefer a slower pace, swing trading involves holding positions for several days or weeks to capitalize on expected upward or downward market shifts.

- News Trading: This technique involves making trades based on news events that have the potential to influence currency prices. It requires a quick reaction to news and the ability to predict how events will impact the market.

Each of these strategies comes with its unique set of challenges and requires a different set of skills. For instance, while algorithmic trading offers precision and speed, it lacks the human intuition that can sometimes be crucial in making trading decisions.

How These Techniques Adapt to the Latest Market Conditions

In 2023, market conditions are characterized by increased volatility and unpredictability, largely due to ongoing global economic challenges and geopolitical tensions. The techniques mentioned above are particularly effective in such a climate due to their adaptability.

Algorithmic trading, for example, can quickly adapt to changing market conditions, making it an effective tool in a volatile market. Similarly, social and copy trading provide an opportunity for less experienced traders to benefit from the expertise of seasoned professionals in an unpredictable market.

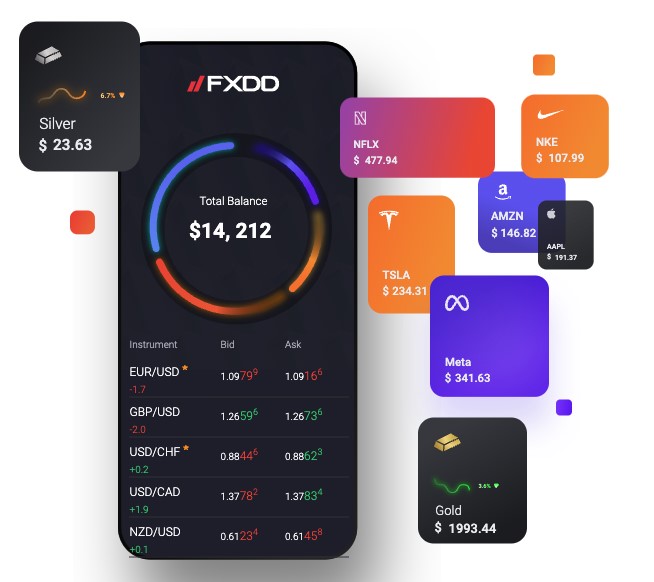

FXDD's Role in Empowering Traders

At FXDD, we pride ourselves on providing a platform and resources that cater to the needs of modern Forex traders. Whether it's access to state-of-the-art trading algorithms, social trading features, or educational resources, we strive to provide our clients with the tools the need to succeed in the ever-evolving Forex market.

Our commitment to personal connection and client-first focus sets us apart from competitors. We understand that every trader's journey is unique, and we provide personalized support to meet your individual needs.

The 5 3 1 Trading Strategy: A Deep Dive

The essence of the 5 3 1 strategy lies in its name. It involves analyzing three different timeframes: 5 minutes, 30 minutes, and 1 hour. The strategy is based on the principle that aligning trends across these timeframes can provide a more accurate and robust signal for entering or exiting trades.

- 5-Minute Chart: Used for identifying the immediate trend and potential entry points.

- 30-Minute Chart: Helps in understanding the medium-term trend and setting up the trade context.

- 1-Hour Chart: Provides insight into the broader market trend and overarching momentum.

Implementation and Adaptation of This Strategy in 2024

With market volatility and technological advancements, the 5 3 1 strategy requires a nuanced approach. Traders must consider external factors such as economic news releases, geopolitical events, and market sentiment analysis. Integrating these factors with the 5 3 1 strategy can yield more informed and timely trading decisions.

Fine-Tuning Your Forex Strategies: Tips to Improve Your Strategy

In the ever-changing world of Forex trading, staying static means falling behind. To keep pace, traders must continually refine and improve their strategies. Let's explore some practical tips and tricks to enhance your existing Forex strategies.

- Backtesting is Key: Before implementing any changes, backtest your strategy with historical data. This will help you understand how your changes would have performed in different market conditions.

- Stay Updated on Market Trends: The Forex market is influenced by global economic, political, and social events. Keeping abreast of these trends can provide insights for tweaking your strategies.

- Incorporate Technological Advancements: To add an edge to your strategy, it's essential to utilize tools like AI-driven analytics and automated trading systems.

- Risk Management Reevaluation: Consistently review and adjust your risk management tactics. This could mean altering your stop-loss orders or diversifying your currency pairs.

- Education Never Stops: Attend Webinars, read the latest Forex literature, and engage with other traders. The Forex market is dynamic, and so should be your learning.

- Learn from Losses: Analyze your losing trades to understand what went wrong. This reflection can provide valuable insights for strategy improvement.

- Adaptability is Crucial: Be willing to make changes to your strategy in response to shifting market conditions. Flexibility can be the difference between profit and loss.

Mastering Forex Strategies: From Learning to Dominance

Achieving long-term success in Forex trading is akin to mastering a fine art. It requires a blend of theoretical knowledge, practical skills, and continuous learning. The journey from a novice to a dominant force in the Forex market involves several stages, each critical in shaping a trader's proficiency.

Forex trading is not just about understanding market trends and economic indicators; it's about applying this knowledge in real-time market scenarios. Theoretical knowledge provides the foundation, nut it is the practical application that truly hones a trader's skills.

For instance, understanding the concept of leverage is one thing, but effectively using leverage in trades without overexposing oneself requires practical wisdom and restraint.

Harnessing the Power of Advanced Forex Strategies in 2024

As we navigate through the dynamic landscape of Forex trading in 2024, the adoption of advanced strategies has become more than a choice - it's a necessity for those aspiring to succeed. We delve into how traders can leverage these sophisticated strategies to maximize their benefits and stay ahead in the ever-evolving Forex market.

- Integration of Technology: In 2024, technology plays a pivotal role in Forex trading. Integrating AI and machine learning tools can significantly enhance the ability to analyze market trends and make informed decisions. For instance, AI algorithms can process large datasets to identify patterns that might be invisible to the naked eye.

- Risk Management Techniques: Advanced strategies often involve higher risks. Implementing robust risk management techniques, such as setting stop-loss orders and diversifying the portfolio, can help mitigate potential losses while capitalizing on high-reward opportunities.

- Adaptive Trading Plans: The market in 2024 is characterized by rapid changes. Having an adaptive trading plan that can be modified as per market conditions is crucial. This might involve switching between strategies like scalping in high volatility scenarios and swing trading during more stable phases.

- Continuous Learning and Adaptation: One of the keys to success is the ability to continuously learn and adapt. This means staying updated with the latest economic news, understanding geopolitical influences, and adapting strategies accordingly.

- Utilizing Advanced Analysis Tools: Utilizing advanced charting tools and technical indicators can provide deeper insights into market movements, helping traders make more accurate predictions. Platforms like FXDD offer sophisticated tools that cater to these needs.

At FXDD, we offer our clients the industry-standard MetaTrader 4(MT4) platform, renowned for its highly customizable interface and unrivaled charting package, catering to the most demanding strategies.

For those seeking advanced graphical charting tools, compelling strategy testers, and a range of pending orders, out MetaTrader5 (MT5) platform is the perfect multi-asset solution, empowering your trading in every conceivable way.

In addition to our MetaTrader offerings, we also provide our clients with access to our web-based platform, FXDD WebTrader. Crafted with precision by our in-house team of experts, FXDD WebTrader is tailor-made for experienced traders seeking direct access to our ECN pricing. With FXDD WebTrader, you're not just getting a platform; you're unlocking a world where tight pricing and swift execution meets convenience. You're plugged in from anywhere.

We also offer our webbased platform for each access, Webtrader, https://www.fxdd.com/mt/en/trading/platforms/webtrader which is is the optimal dealing platform for advanced users to access FXDD’s ECN pricing. Designed and built in-house by FXDD developers,Webtrader is geared to the requirements of today's most savvy traders from which you can take advantage of tight pricing and swift execution from anywhere - Building a Network: Engaging with a community of traders, sharing insights, and learning from others' experiences can provide valuable perspectives that are not available from charts and data alone.

Key Takeaways from Advanced Forex Strategies

Advanced Forex strategies in 2024 demand a blend of technological adeptness, strategic foresight, and risk management. By embracing these methods, traders can not only enhance their profitability but also position themselves effectively in a competitive market.

Now is the time to elevate your Forex trading experience by integrating these advanced strategies into your approach. Join us at FXDD, where we provide not just a platform, but a partnership to navigate the complexities of Forex trading.